Photovoltaic Frame Industry: Leading Companies Expand Overseas, Marketization Accelerates, Small Enterprises Exit

1.The booming photovoltaic industry has provided robust growth momentum and vast market opportunities for the photovoltaic frame sector.

Photovoltaic frames are a critical auxiliary material in solar modules, accounting for approximately 14% of the cost structure. They feature lightweight construction, high strength, excellent weather resistance, and strong corrosion resistance. These characteristics enable them to play a vital role in securing and sealing solar cell assemblies, not only enhancing the mechanical strength of the modules but also extending their overall service life.

With the advancement of China's “dual carbon” strategy and the implementation of related policies, the photovoltaic industry has experienced rapid development. The continuous increase in new and cumulative installed capacity, coupled with the rapid growth in PV module shipments, has brought significant growth opportunities and vast market potential to the PV frame industry.

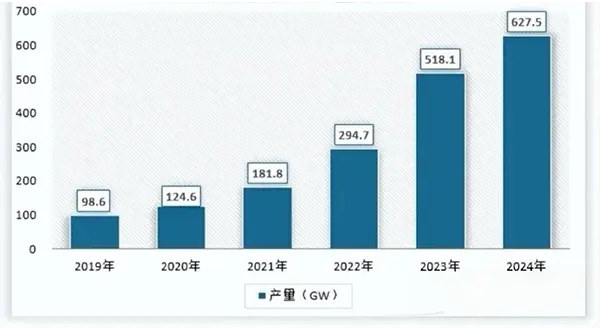

Statistics indicate that from 2019 to 2024, China's new PV installed capacity surged from 30.1 GW to 277.17 GW, while cumulative capacity expanded from 204.2 GW to 886.66 GW, reflecting compound annual growth rates (CAGRs) of 55.90% and 34.13%, respectively. During the same period, PV module production soared from 98.6 GW to 627.5 GW, achieving an average annual growth rate of 44.79%. From January to July 2025, new installed capacity further increased to 223.25 GW, representing an 81% year-on-year growth. Cumulative installed capacity surpassed 1,100 GW, further driving robust demand for upstream products such as PV frames.

2.Aluminum alloy frames dominate the photovoltaic frame market, while composite material frames are accelerating their market penetration.

Photovoltaic frames can be categorized by material into aluminum alloy, steel, and composite types. Aluminum alloy frames dominate the industry with a penetration rate exceeding 95% due to their lightweight, long lifespan, corrosion resistance, and mature technology. However, research from Guanyan Report indicates that composite frames, with superior weather resistance, lighter weight, lower cost, excellent insulation, and resistance to potential-induced degradation (PID), are particularly suited for offshore PV and highly corrosive environments. The production process of composite frames emits over 60% less carbon than aluminum alloy, presenting significant market development opportunities.

Although the current technology and standards system are not yet mature, the commercialization process continues to accelerate. Multiple companies are driving the certification and capacity expansion of composite frames. For instance, the first phase of Beijing Institute of Technology Tongchuang's basalt composite PV frame production has commenced, Aina New Energy has achieved substantial production capacity, and Zhen Shi Co., Ltd.'s products have obtained PCCC certification. This indicates that composite frames are gradually emerging as a formidable competitor in the PV frame market.

Overall, although composite material frames are still in the early stages of marketization, their performance advantages—including weather resistance, lightweight properties, and low cost—combined with breakthroughs in product certification and capacity expansion by enterprises, are accelerating their market adoption. This not only lays a solid foundation for subsequent market applications but also creates conditions for the gradual expansion of market opportunities.

3.Small photovoltaic frame enterprises are under pressure to exit, while leading enterprises are vying to expand overseas

Prior to 2021, aluminum ingot prices remained relatively stable, enabling substantial profit margins within the photovoltaic frame industry. Many private SMEs maintained decent gross margins despite lacking advantages in manufacturing experience, process capabilities, and product yield rates. However, starting in the second half of 2021, influenced by dual-control policies on energy consumption and restrictions on electricity supply and production, aluminum ingot prices began fluctuating upward. Compounded by the weak bargaining position of photovoltaic frame manufacturers in negotiations with downstream module manufacturers, making it difficult to pass on cost pressures, these factors led to a significant compression of profit margins for small enterprises. In this market environment, companies with outdated technology and equipment, as well as inadequate quality control capabilities, were gradually eliminated.

Conversely, large enterprises leveraged robust capital strength, advanced production equipment, and superior quality control to better withstand raw material price fluctuations. Their competitive edge strengthened, steadily increasing market share. Furthermore, driven by global demand for green, low-carbon energy, leading companies like Yongzhen Co., Ltd. and Xinbo Co., Ltd. began actively expanding into overseas markets. For instance, Yongzhen Co., Ltd. has established a production base in Vietnam targeting the U.S. and Indian markets, while Xinbo Co., Ltd. is developing a photovoltaic aluminum frame project in Malaysia.

Looking ahead, competition in the photovoltaic frame industry will center on supply chain resilience, technological advancements (such as the application of composite material frames), and green, low-carbon capabilities. Leading enterprises are expected to further consolidate their market positions through comprehensive competitiveness, with industry concentration projected to rise steadily.